Some Of Insurance Meaning

Wiki Article

What Does Insurance Quotes Do?

Table of ContentsNot known Facts About Insurance AsiaThe Basic Principles Of Insurance Ads Indicators on Insurance Asia You Should Know3 Easy Facts About Insurance Asia Awards DescribedThe Ultimate Guide To Insurance AdvisorInsurance Asia Awards - Questions

Handicap insurance policy can cover irreversible, short-lived, partial, or complete special needs. It does not cover clinical care and solutions for lasting care.

Life Insurance for Children: Life insurance coverage exists to replace lost income. Accidental Fatality Insurance Coverage: Even the accident-prone ought to avoid this type of insurance coverage.

It's best to take a stance someplace in between these 2 attitudes. You must certainly consider buying all or a lot of the 5 required sorts of insurance policy stated above. These are one of the most crucial insurance kinds that give significant economic relief for very practical scenarios. Beyond the 5 primary sorts of insurance policy, you ought to think meticulously before buying any kind of extra insurance policy.

Rumored Buzz on Insurance

Keep in mind, insurance is suggested to shield you as well as your finances, not injure them. Associated From spending plans and costs to cost-free debt score and even more, you'lldiscover the effortless means to stay on top of it all.There are many insurance policy options, as well as lots of economic experts will state you need to have them all. It can be challenging to identify what insurance policy you actually require.

Elements such as children, age, way of life, as well as work advantages contribute when you're constructing your insurance policy portfolio (insurance agent). There are, however, four kinds of insurance that most economists recommend all of us have: life, health, car, and long-term disability. 4 Kinds Of Insurance Policy Every Person Demands Life insurance policy The biggest advantages of life insurance policy include the capacity to cover your funeral service expenditures as well as offer those you leave.

The Buzz on Insurance Agent

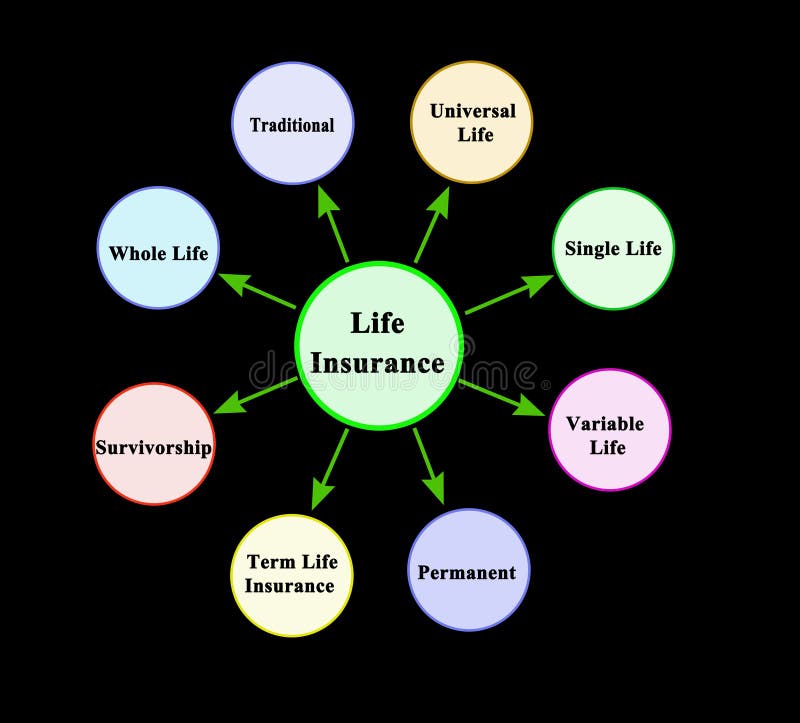

Both basic sorts of life insurance policy are standard entire life and term life. Simply clarified, whole life can be used as an earnings device along with an insurance tool. As long as you remain to pay the monthly premiums, entire life covers you till you pass away. Term life, on the various other hand, is a plan that covers you for a collection quantity of time.

Usually, also those workers that have terrific wellness insurance, a great savings, and an excellent life insurance coverage policy do not prepare for the day when they may not be able to benefit weeks, months, or ever once again. While medical insurance spends for a hospital stay and medical costs, you're still entrusted those day-to-day expenses that your paycheck normally covers.

Not known Details About Insurance Commission

Several employers supply both short- and also lasting impairment insurance as part of their advantages bundle. This would certainly be the finest alternative for securing economical disability protection. If your company doesn't use lasting coverage, right here are some points click for more to consider before buying insurance coverage on your very own. A policy that guarantees revenue substitute is optimal.7 million automobile crashes in the U.S. in 2018, according to the National Highway Web Traffic Security Management. An approximated 38,800 people passed away in vehicle crashes in 2019 alone. The leading reason of fatality for Americans between the ages of five and also 24 was car crashes, according to 2018 CDC information.

7 million drivers and travelers were hurt in 2018. The 2010 economic expenses of automobile mishaps, consisting of fatalities as well as disabling injuries, were around $242 billion. While not all states need vehicle drivers to have vehicle insurance coverage, the majority of do have guidelines regarding financial responsibility in the occasion of a mishap. States that do require insurance coverage conduct regular random checks of chauffeurs for evidence of insurance coverage.

The Only Guide to Insurance Agent Job Description

If you drive without automobile insurance coverage and also have an accident, fines will possibly be the least of your economic worry. If you, a passenger, or the other motorist is wounded in the accident, car insurance policy will certainly cover the expenses as well as assist secure you versus any kind of lawsuits that might result from the crash.Again, similar to all insurance policy, your specific circumstances will certainly identify the price of automobile insurance coverage. To ensure you obtain the ideal insurance policy for you, contrast several rate quotes as well as the coverage given, as well as inspect occasionally to see if you receive reduced rates based on your age, driving Get the facts document, or the location where you live (insurance commission).

If your company doesn't supply the kind of insurance coverage you want, get quotes from a number of insurance providers. While insurance is pricey, not having it could be far much more expensive.

The Main Principles Of Insurance Code

Insurance coverage resembles a life coat. It's a little bit of a nuisance when you don't need it, however when you do need it, you're more than glad to have it. Without it, you can be one car accident, illness or house fire away from drowningnot in the sea, however in the red.Report this wiki page